How to Choose Bike Insurance

Coverage, costs, and theft protection

Your bike is more than a mode of transportation—it’s a passion and a valuable investment. With bicycle theft on the rise and more riders investing in high-end models, finding the right bike insurance is more important than ever. In this guide, you’ll learn how to compare policies, avoid common insurance pitfalls, and save on premiums with tools like BikeFinder.

Why is bike theft such a big threat to your ride?

Bike theft has evolved into an organized crime. Professional thieves now use high-tech tools and coordinated tactics to target expensive bikes. Insurance isn’t just an option anymore—it’s a smart layer of protection. And when combined with a GPS tracker and strong security habits, it significantly increases your chances of recovering your ride.

In this article, we’ll cover:

- How your home insurance may fall short

- How to easily compare insurance policies

- Traveling with your bike

- Why strong locks, GPS tracking and proper documentation matter

- Cheaper insurance by bundling with a tracker like BikeFinder

Does home insurance cover bike theft?

Many cyclists assume their home or renters’ insurance will cover bike theft, but this often comes with serious limitations:

- Low coverage limits, sometimes only a few hundred euros/pounds

- Exclusions for theft outside the home, like at the office or from a bike rack

- High deductibles

- Risk of a higher home insurance premium after a claim

- Lengthy or unclear claims processes

Always check the policy documents closely, especially for high-value bikes. In most cases, a dedicated bike insurance policy provides far better protection.

How to compare bike insurance: read the IPID

When evaluating bike insurance, don’t just look at price—compare the terms too. A great tip is to review the Insurance Product Information Document (IPID). This is a standardized 2-page summary that outlines:

- What is covered

- What’s excluded

- Obligations for the insurance taker

- Cancelation process

The IPID helps you quickly compare policies, without reading 50-page terms and conditions. You’ll find this with most regulated insurers in the UK and EU.

“Home and travel insurance is not designed with cycling enthusiasts in mind – that’s why we exist! “

— Alan, CYCLER Insurance

Traveling with your bike? Make sure you’re covered

Heading abroad for training, racing or a cycling holiday? Then you’ll want to make sure your insurance includes:

- Worldwide coverage

- Number of covered days abroad per year

- Transit protection for air, train or shipping transport

Tip: Always pack your bike in a dedicated bike travel box or hard case to reduce the risk of damage and to remain eligible for coverage.

The right lock matters

Even the best insurance policy expects you to use a proper lock. Here’s a breakdown:

- D-locks/U-locks: Strong and commonly approved by insurers (Sold Secure Gold or Diamond)

- Chain locks: Great for flexibility and security; must be high-grade steel

- Folding locks: Compact, but check if they meet your insurer’s standards

- Cable locks: Lightweight but usually easy to cut through and not insurance-proof

Always check if your insurer has an approved lock list—using the wrong type could void your claim.

Be ready for a claim: store your proof in one place

If the worst happens, your insurer will need:

- Proof of ownership (receipts or invoices)

- Photos of your bike and eventually of the accessories

- Police report (in case of theft)

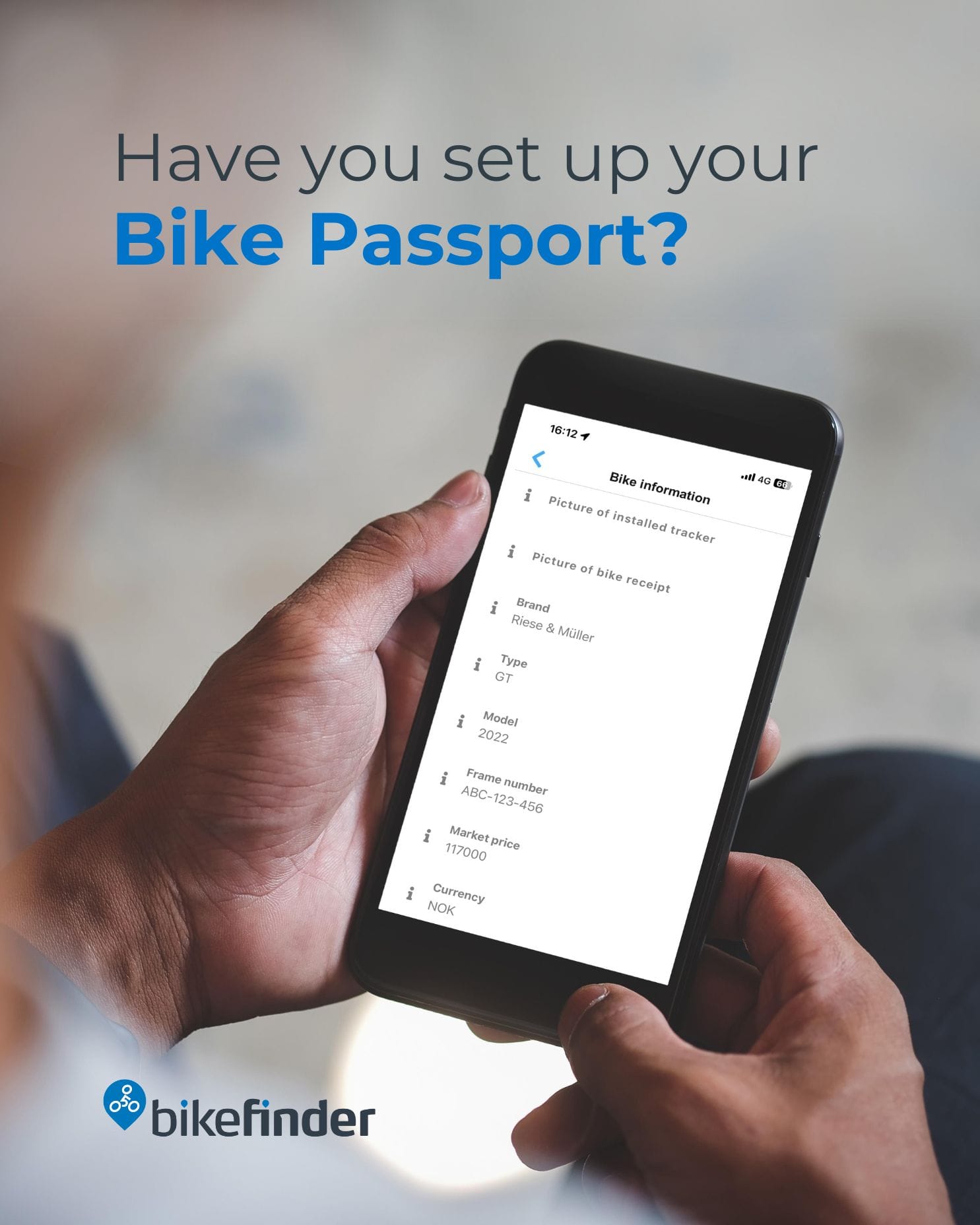

The BikeFinder app makes it easy to stay prepared. Store all your important documents—receipts, bike images, tracker data, and specs—in one secure place. Think of it as your digital Bike Passport, ready when you need it most.

Available on both the App Store and Google Play, the BikeFinder app helps you submit faster, smoother claims with everything at your fingertips—no digging through emails or folders.

Cheaper insurance by bundling with a tracker like BikeFinder

A tracker isn’t just about peace of mind—it can save you money. Insurers now recognize that anti-theft trackers like BikeFinder significantly reduce the risk of permanent loss and the likelihood of claims.

With BikeFinder:

- Always know where your bike is

- An 80% recovery rate for stolen bikes

- All-in-one app to store bike details, receipts, and claim-ready documentation

Thanks to this added layer of security, insurance premiums are 50% cheaper for our customers in the UK for example. That’s because insurers know they’re far less likely to pay out when a tracker is in place.

Take away: Layered security is smart security

The best approach to bike protection is layered:

1. Use a high-quality, insurer-approved lock

2. Install a GPS tracker like BikeFinder to increase your recovery chances

3. Get a dedicated bike insurance policy that covers your needs

4. Keep your documentation and receipts safe in the BikeFinder app

Cycling should be about freedom, not fear. The right insurance paired with smart tools and good habits can help keep your ride safe.

🔷 Explore the BikeFinder tracker & insurance in one!

🎥 Watch expert tips and tricks from our UK insurance partner on our YouTube channel.